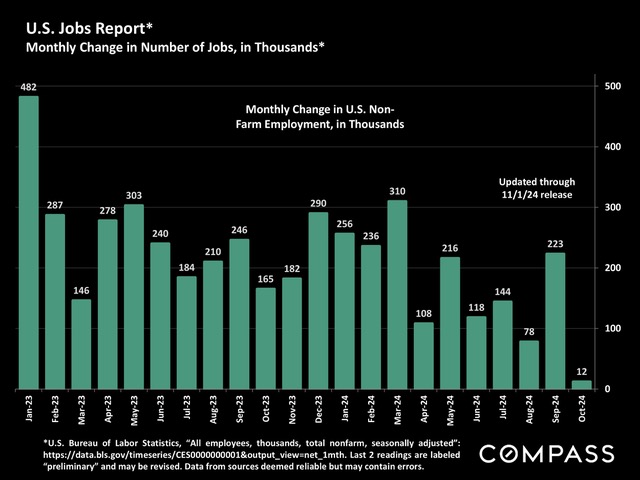

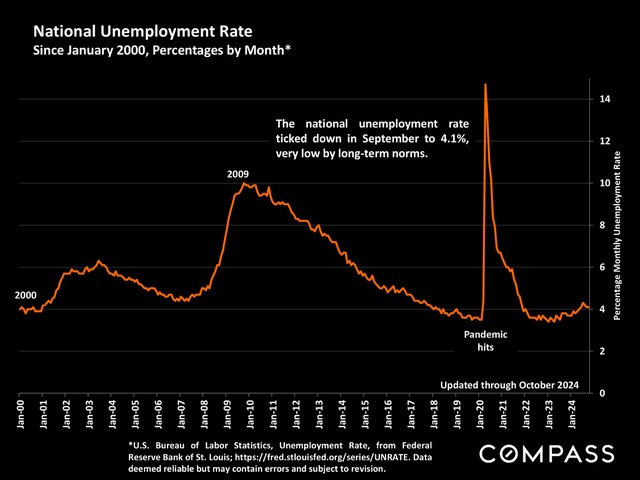

National Jobs Report & Unemployment: The unexpectedly high new jobs number in September – which made interest rates spike up in early October – was revised downward by 10%, and the October jobs number just came in at its lowest count since December 2020: Some ascribe the plunge to the effects of the 2 recent, terrible hurricanes. The unemployment rate was unchanged at 4.1%. So far this morning, stock markets are up and interest (bond) rates are seeing little change.

It’s worth pointing out that the latest economic indicators put out by the government – over which stock and bond markets can react very dramatically – are initially labeled “preliminary” and often subsequently revised, sometimes substantially.

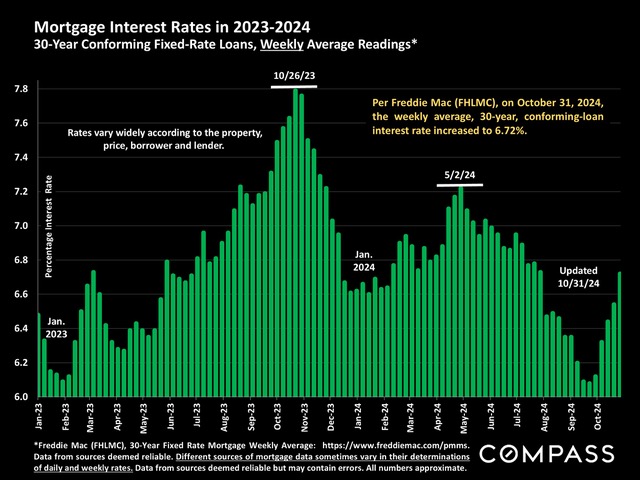

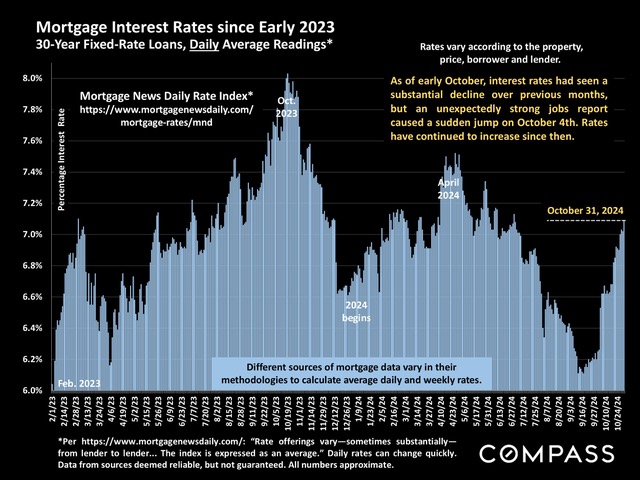

30-Year Loan Rates, Weekly & Daily Averages (the providers of this data use different methodologies, though the trends are very similar). It’s been a tough month for interest rates and the analyst forecasts of late September – that rates were heading down through the end of the year – were almost universally wrong (so far).

“Increasing for the fifth consecutive week, mortgage rates reached their highest level since the beginning of August. With several potential inflection points happening over the next week, including the jobs report, the 2024 election, and the Federal Reserve interest rate decision, we can expect mortgage rates to remain volatile. Although uncertainty will remain, it does appear mortgage rates are cresting, and are not expected to reach the highs seen earlier this year.” Freddie Mac, 10/31/24

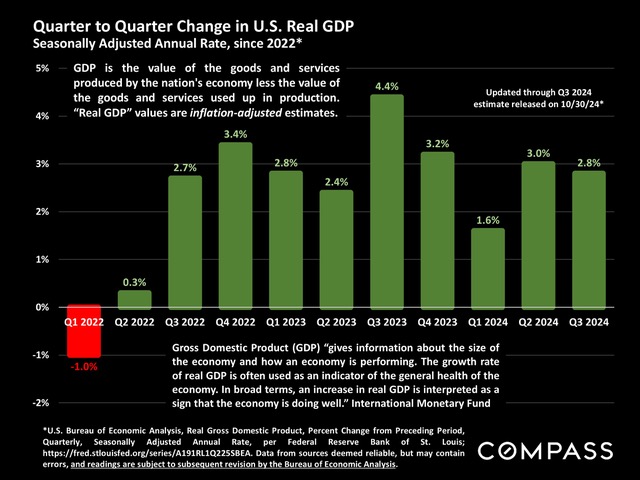

Real GDP continued to see robust growth in Q3.

Stock markets: As of this morning, the 2 main stock indices were climbing, though that’s a little hard to see in this chart.

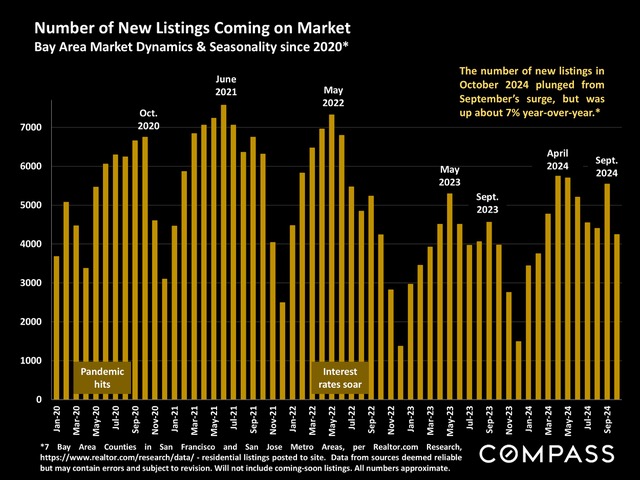

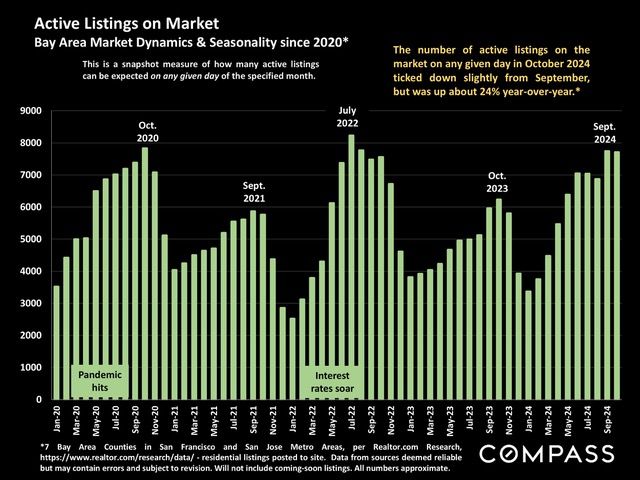

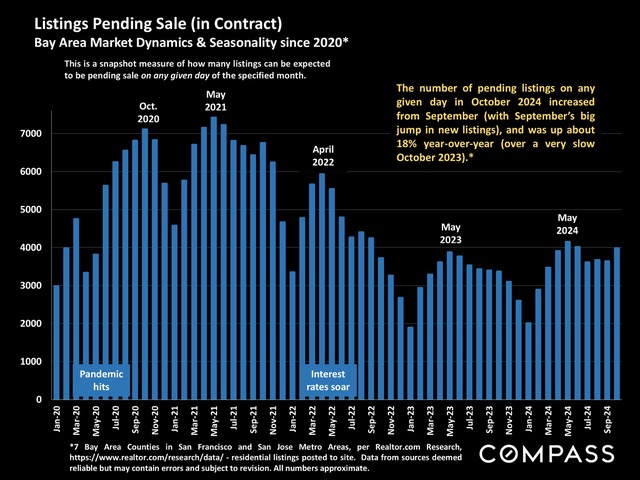

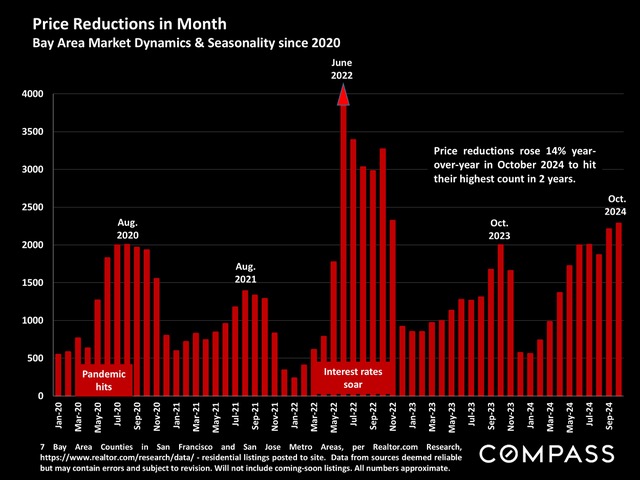

Bay Area, preliminary supply & demand snapshots: New, active & pending listings; price reductions. Generally speaking, the trends we’ve been seeing since spring have continued: More inventory, lower absorption, more price reductions. Listing and sales activity typically begins to plunge in November and December.